lakewood sales tax online filing

Box 1305 Englewood CO 80150-1305. Start my free trial.

Job Opportunities City Of Lakewood Career Pages

Manage your tax account online - file and pay returns update account information.

. Provide the City of Lovelands Access ID 8846000609 for ACH Debit Payments to your bank. Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood. All businesses in the City of Englewood are liable for the 35 tax on the tangible personal property used or consumed in their business.

Automate sales tax preparation online filing and remittance with Avalara Returns for Small Business. Lakewood To Host Four Community Open Houses To Discuss The Health of Lakewood June 06 2022. File Sales Tax Online.

Lakewood Economic Development makes sure your start-up existing or expanding business benefits from the Citys collaboration and support. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis. The Lakewood sales tax rate is.

The Lakewood Municipal Income Tax Division Division of Municipal Income Tax 12805 Detroit Ave Suite 1 Lakewood OH 44107 Phone. Use Tax The City also has a 35 Use Tax. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month.

View your Account history. That are not resold or remanufactured by you. You MUST enter zeros in front of your account number to equal a total of five digits in order for your account to be found and added to your profile.

The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Online Preparation of your 2021 City of Lakewood Income Tax Return.

The seminal event in American history blazes to vivid life in this most beautiful and unconventional. Business Licensing Tax. Sales Use Tax.

There are a few ways to e-file sales tax returns. Create a Tax Preparer Account. Historic Preservation Tax 2009 - Ordinance No.

Manage My BusinessTax Account password required Online Payment Options. Give feedback about projects and issues. License file and pay returns for your business.

Sale Tax Online information registration support. Consumer Use Tax 2011 - Ordinance No. Tax rates are provided by Avalara and updated monthly.

The Lakewood Sales Tax is collected by the merchant on all qualifying. Sales and use tax returns are due on the 20th day of each month following the end of the filing period. Ad New State Sales Tax Registration.

Lakewoods Heritage Culture the Arts is excited to share a diverse lineup of performances coming to the summer concert. Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Receive Lakewood City News Updates Email Constant.

Sales and Use Tax 2002 - Ordinance No. Sales tax returns may be filed annually. The tax rate for most of Lakewood is 75.

Skip to main content. Once youve created your PIN and logged into our system you may prepare your 2021 City of Lakewood income tax return online file an extension andor check your estimates and prior year credits. Returns can be accessed online at Lakewood.

Learn more about transactions subject to Lakewood salesuse tax. See Available Tax Returns. Payment Taxes Recent News.

This includes purchases and leases of equipment materials supplies etc. Pay water sewer and stormwater utility bills traffic tickets and business tax returns. Input your social security number or the primarys social security number in the case of a joint account and create a PIN number by clicking on the Dont.

If you have more than one business location you must file a separate return in Revenue Online for each location. Sales and Use Tax 2011 - Ordinance No. 800 AM to 430 PM.

For additional e-file options for businesses with more than one location see Using an. License file and pay returns for your business. Step by step instructions.

The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. Learn more about sales and use tax public improvement fees and find resources and publications. There are a few ways to e-file sales tax returns.

This is the total of state county and city sales tax rates. Your location must be typed exactly as it is written on your sales tax license. Get the latest city information.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Join Us for the City Council Meeting Tonight June 06 2022. We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas.

Get Involved - Stay Informed. To utilize the e-filee-pay system. Look up 2022 sales tax rates for Lakewood Colorado and surrounding areas.

Lakewood OH 44107 216 521-7580.

Business Tax Classes Department Of Revenue Taxation

Daniel Duvall Alpha Scofflaw Team Dooovall Linkedin

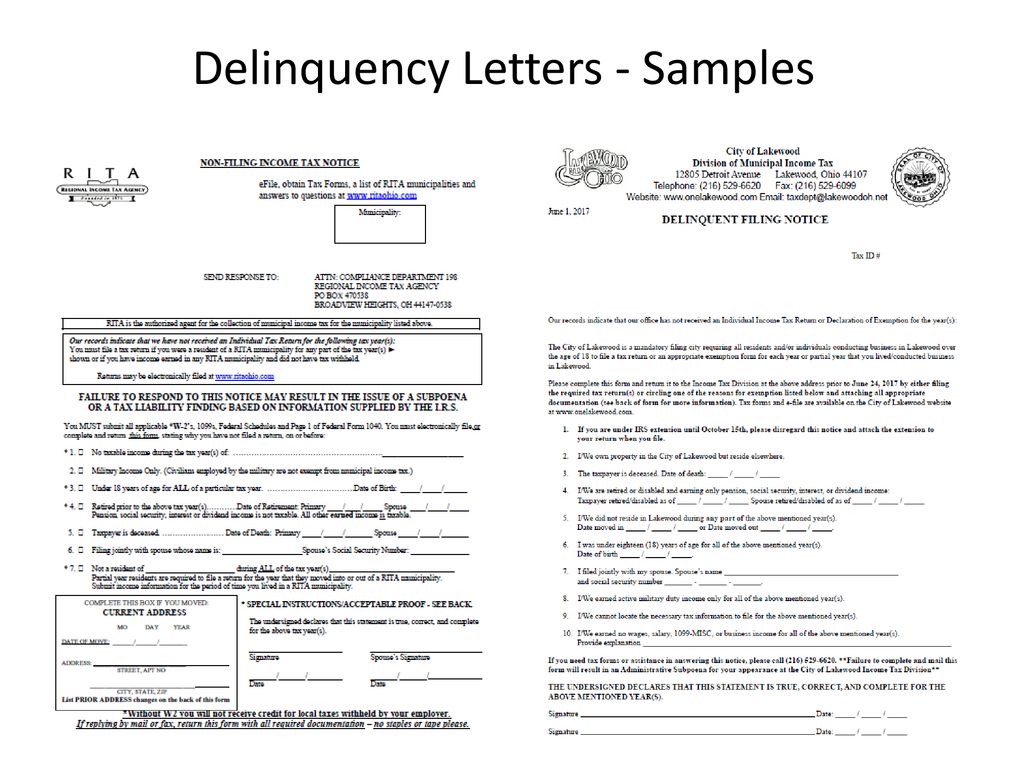

Delinquent Tax Collections Ppt Download

1730179714 Npi Number Lakewood Ranch Medical Center Bradenton Fl Npi Registry Medical Coding Library Www Hipaaspace Com C 2022

Colorado Mills Closure Means Lakewood Could Lose 350 000 A Month In Taxes 9news Com

Delinquent Tax Collections Ppt Download

Delinquent Tax Collections Ppt Download

Delinquent Tax Collections Ppt Download

/cloudfront-us-east-1.images.arcpublishing.com/gray/CWEHI6BIIZEDBKHTKM7SXBSDD4.jpg)

Pittsylvania County Residents Deny Opportunity For Sales Tax